How to Protect Yourself from Davos Man

The pandemic is clearly in the rear-view mirror, no matter how badly the our elites wish it wasn’t so. The window on the World Economic Forum’s self-proclaimed “opportunity” for transformative change is quickly closing. Yet, billions of plebes are still dragging their knuckles around, thinking for themselves.

Anybody paying attention to the talking points coming out of this past Davos meeting, knows what they have planned for us: everything from individualized carbon footprint tracking, the requirement for “passports” to navigate the web, to “recalibrating certain human rights… like free speech”

This three part piece takes us through what we’re dealing with, why it’s actually impossible for it to succeed, and what you can personally do to secure your own future regardless.

#1) Know what you’re dealing with

The Davos Club are at their core, Malthusians and Marxists. By Malthusian I mean that they think there are too many useless eaters in the world taking up space and resources. You’re one of them. They’re not.

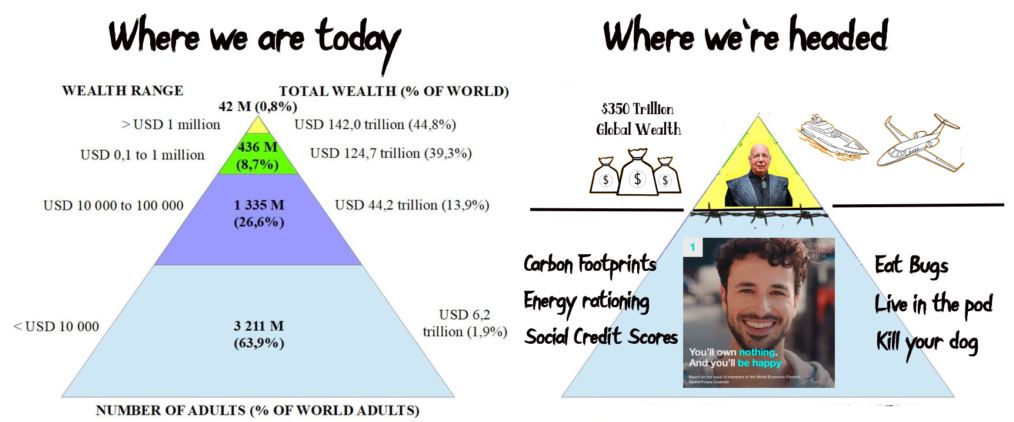

By Marxist I mean the true outcome of socialism: a two tier society. Ostensibly, Marxism is about class struggle and equality for all, but in reality it’s about about eliminating the middle class and the reduction of the class structure to only two:

- them, a thin scab of elites who sit atop the cap table of the world, who own everything and make all the rules, and

- everybody else, who own nothing and have no human or civil rights.

Class structure, now and future

Anything that comes out of Davos, no matter how noble it sounds is really just veneer to get enough useful idiots to convince enough useless eaters to accept the narrative that what is being done to them is for their own good. This year took aim at individual carbon footprints.

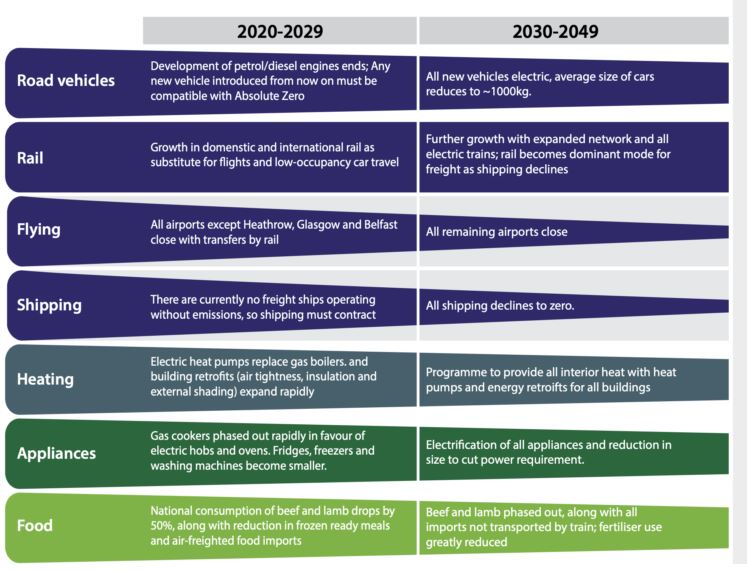

UK Fire, is a British think tank with a five year mission to map out a pathway to Absolute Zero by 2050. Funded by the UK government’s UK Research and Innovation, along with “an active and growing industrial consortium”, their plan is to eliminate all carbon emissions by 2050.

All of them.

This includes:

- Elimination of air travel by 2050

- Elimination of shipping (there are no electrically powered ships)

- The phasing out of beef and lamb for food (replaced by vegetarian food)

- Radical reduction of steel manufacturing and all blast furnaces

- Elimination of cement (expand use of clay, “think up something else”, literally)

- 60% fewer cars, or 60% smaller in size

It’s an epic 60-page report that has it all figured out, most importantly how everybody else is going to live.

The punchline being the complete elimination of fossil fuels by 2050.

But if there’s one thing you can bet on it is this:

In 2050, the Royal Family, members of the government, billionaires and industrialists will all still be flying around in private jets or sailing somewhere aboard super-yachts, eating grass fed beef, lamb, bison, and being chauffeured around in 25-foot limos between their multiple 10,000 to 25,000 square foot residences.

Some people are angered by these machinations of our self-appointed betters. The idea that the people who come up with these schemes will get to retain all the trappings of a modern, luxurious lifestyle while taking them all away from the rest of us in the name of “climate justice” or “equity” seems, somehow… unfair.

To put it lightly.

But when you fall into the trap of getting triggered by these plans, these high minded “roadmaps” and all encompassing agendas you’re actually falling into a type of mental trap that will compromise your own ability to mitigate these machinations.

It’s therefore important to:

#2) Understand that it’ll never happen

One of the most sanity preserving mental tools I’ve ever discovered is what I call “Embracing the recipriversexcluson“.

The term was invented by Douglas Adams in his satirical classic “Hitchhikers Guide To the Galaxy”. It means: a number whose value can be anything but itself.

His example was the stated hour of a dinner party is the one moment in time when it is impossible for any of the guests to arrive.

In this world of management by technocrats and expert authorities, we are immersed in recipriversexclusons:

- If the most wizened technocrats say “sub-prime is contained”, it isn’t.

- The future inflation targets are the one value inflation can never have

- GDP estimates, CPI, PPI, money velocity, all of it, aren’t predictions, they’re exclusions

There is a kind of ontological structure to why this is the case: knowledge of the future (predictions) never occur in a vacuum. Putting the prediction into the world (planning) by that very act creates reinforcement and opposition. However both forces reduce the odds of the outcome matching the prediction.

The reason why can be understood by looking at something called the Three Body Problem. It’s a physics concept which states that it is impossible to create an algorithm that describes the movement of three disparate objects in space.

The ramifications of this are far reaching.

Without getting too long-winded about it, I’ll distill it down to this:

The World Economic Forum could not successfully execute a plan for total world domination, even if the entire world consisted of only three inanimate objects.

I’m oversimplifying. But the upshot is that central planning is futile. Whether it’s Soviet-era Five-Year Plans or FOMC models for transitory inflation, the Three Body Problem suggests that there are simply too many moving parts in the world to be able to plan and control macro outcomes.

If there is no solution to calculating the trajectory of three independent entities even five minutes from now, never-mind trying to control the outcome of the entire global economy (or the planet’s climate) out past 2050.

What can happen though, and frequently does, is you can cause a lot of damage via central planning. You can screw up everybody else’s plans, even the individual ones that would have otherwise landed in the ballpark. So for interim periods of time, central planning can appear to be omnipotent, but if you look closely, none of those plans actually succeeded at anything other than derailing everybody else’s lives (COVID, lockdowns, vaccines, etc).

Any time central planning or technocratic impulses appear to be in control of anything, it’s, as a rule never what was intended. More often it’s a train wreck of unintended consequences. If that wasn’t the case, we wouldn’t have runaway inflation, we’d have had a soft-landing in the rate hikes, 100% vaccine compliance, Russia wouldn’t be Ukraine, the supply-chain would be humming along, oil wouldn’t be over $100/barrel and Bitcoin would be a zero,

#3) What you actually do about it

There is a great difference between resisting evil and renouncing it. When you resist evil, you give it your attention; you continue to make it real.

When you renounce evil, you take your attention away from it and give your attention to what you want.

Now is the time to control your imagination and give your energy to what you want.”

— Neville Goddard

This quote provides a nice encapsulation for the decentralized revolution and the emergence of Bitcoin. This movement is not a full frontal assault against globalism, nor is it a fear-based reaction to any impending attempts at tyranny.

It is a worldwide, unstoppable opt-out. People are putting their energy literally into what they want. Non-state, neutral, digital bearer instruments, absolute property rights, and self-sovereign autonomy.

That’s what I want. That’s what many of you want. I really don’t give a rat’s ass what Klaus Schwab, Justin Trudeau or any of the collectivist eggheads who authored Absolute Zero 2050 want.

The reality is nobody is control, and for both the elites, and the NPCs who love to to have their lives ordered by them, that is terrifying.

We live in an out-of-control world, and yet each one of us are bestowed with a few super-powers that give us the ability to rise above any adversity or undesirable circumstances.

Those super-powers are the ability to adapt, learn and our ability to think creatively. Individually, any single person can rise above their circumstances. In parallel, we can upend entire empires.

Smash Your Great Barrier

In order to be able to live your life irrespective of how Davos Man thinks you should, you have to be independently wealthy. That may not be ideal or fair, but that’s how it is. If you aren’t independently wealthy as we go through this Fourth Turning of history, then there’s high likelihood you’ll be a neo-Feudal serf, trapped within a social credit system, living on stimmies (CDBCs), and doing what you’re told.

By independently wealthy, I mean not reliant on single external entities, and especially not on government entitlements. If you live in a trailer on a plot of land that you own free and clear and have a viable niche in your community, you’re independent. You’re in better shape than the mid-level investment banker whose bonus is $750K but he’s several million in debt over and above his assets.

If you aren’t where you want to be financially now (and it’s not because you’re still in school or otherwise laying the foundation for your future), then there’s one step you have to do first, which clears the path toward financial independence.

You have to identify your one crippling barrier to being who you want to be, and get rid of that obstacle. You probably already know what The Great Barrier is in your life, because you spend a lot of your mental energy pretending it’s not there or not a problem. Maybe it’s drugs, booze, negative thinking, sex, porn, co-dependancy, television, Youtube, who the hell knows these days. Being a Karen. Whatever it is, just stop it (for years I’ve been trying to figure out who wrote this book, but if you’re at this stage where you need to deal with your Great Barrier, then get it and read it, it’s under $3 for chrissake).

At the age of 30 I was broke, in debt, an alcoholic, alone and suffering from depression and crippling anxiety. Now I’m not. My Great Barrier was the booze. So I stopped drinking.

It’s hard to believe that was only 22 years ago, because I’ve come a long way since, and risen to comparatively dizzying heights. I am not especially gifted nor talented. If I can do it, so can you.

Become financially independent

After you smash through your Great Barrier, the first job if you’re not financially independent, is to do that. Become that. Yes, it’s that simple. You make the decision and then you go out and do it. If your Great Barrier was an addiction, you’ll actually have so much extra time and money it will feel positively pink cloud-ish. Use that lift to get up to speed on financial literacy and then the way you get there is through starting or owning a business. Even one on the side.

Think for yourself

Start jettisoning low-signal inputs:

- Television

- All mainstream/corporate media

- Social media – massive curation will required here

- All politicians

- Expert authorities

You have to start paying attention to what’s going on in your head most of the time, and then ask yourself if it’s something put there by an external influence or if you’re actually expending brainpower on your own plans, goals and relationships.

People can waste their entire day on whatever Twitter puts in the “What’s Trending” bar. They can get caught up ruminating on external events, people and behaviours they have no control over and will almost never impact them.

Have a goal. Come up with a plan. Spend as much of your mental energy thinking about your goals and your own plan.

Think Napoleon: .

“I see only the goal. The obstacle must give way”

— Napoleon

Or the other Napoleon:

“Choose your goals.

Work toward them.

Direct your thoughts.

Control your emotions.

Get into action…

and you ordain your Destiny”

— Napoleon Hill, W. Clement Stone

Cultivate Optionality

Once you’re the captain of your own ship, you’ll still have to navigate the machinations of innumerable external authorities who think they have moral claim over your life.

You do that by cultivating optionality. A wizened lawyer once told me, “he who has the most options, usually wins”.

When you’re on a single paycheque, over your head in debt or reliant on government stimmies, you have no choices. Basically you live at the whim of your circumstances.

As we say in The Crypto Capitalist Letter (our premium channel) “We worship at the alter of optionality”.

- Multiple streams of income

- Multiple business interests

- Diverse assets (i.e. gold and Bitcoin)

- Plan B (second passports, out of country real estate)

Notice I didn’t say “Buy Bitcoin” in the section about achieving independent wealth. That’s because it most properly belongs in this section.

Bitcoin is the ultimate optionality, because it’s such an asymmetric set up. If you are 100% no-coiner, backed-by-nothing, ponzi, Tulips, headed to zero, then what kind of premium would you pay for Dead Wrong Insurance?

Imagine an insurance policy that covered you against being absolutely, totally wrong about something as important as the future of the global monetary system. What would that be worth to you?

$5? $10? If that’s all you’d be willing to concede that you might be proven wrong about Bitcoin, then take that five or ten dollar bill down to the nearest Bitcoin ATM and buy a few sats of Bitcoin. Then do it again next week. Do it every time you’re at the store pissing away the rest of your money on lotto tickets and cigarettes and in due course you’ll have a cushion that could make all the difference in the world if the Bitcoin thesis plays out.

If you’re higher up the spectrum such as a HNW or family office, think about allocating 0.5% or 1% into Bitcoin. That’s it. Then forget about it.

Be Ready

Being a Sovereign Individual (this is basically what we’ve been laying out herein) requires commitment and preparation. You don’t have to do it, but just understand that if you don’t, we’re headed into a world where you’re probably going to spend the rest of your life doing what you’re told instead of what you want.

We’re in an air pocket now, the job is resiliency, because we’re transitioning out of an existing system that is no longer functional, and into a new one. Nobody really knows how it looks yet.

The tension between Davos Man and the Sovereign Individual is that the former wants to keep the old system going as a linear extension into the future: more centralization, more top down control, more confiscation of any remaining wealth.

The latter may not know what the future looks like but we know what it won’t look like: it won’t be a digitized linear extrapolation of the Industrial Age.

Aside from that, all bets are off, so we we need all manner of resiliency.

-

- Backup generators

- Medical Supplies

- Tools

- Food

- Lawyers, guns & money

We also have to connect with each other and create our own support structures because the government, the experts, the Davos crowd, they are not coming in to save us. My guess is in the not-so-distant future their primary concern will be outrunning the pitchforks and torches. So be it.

In Bitcoin circles there is a meme: WAGMI. I’ll leave it to the reader to find out what that means if they don’t already.

Many people believe that Davos Man controls the world and is steering everybody into a technocratic authoritarianism. Davos Man assuredly aspires toward this.

The laser-eyes, those who think WAGMI have their own designs on how things will play out. It is largely a global opt-out as incumbent institutions lose credibility, and their authority and importance in world affairs goes into secular decline.

Either way, they are both correct.

It will be largely self-selecting.

- Source : Mark E. Jeftovic