US Sanctions Block Flow Of Russian Diamonds To India

The sanctions placed by the US OFAC on Russian diamond producer Alrosa PJSC earlier this month have blocked the flow of Russian diamonds to India.

Do you have diamonds in your possession? It could be time to contact your local jeweler and get them re-evaluated. This is why:

The US Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Russian diamond producer Alrosa PJSC earlier this month, removing a third of the world’s rough diamond supply.

According to Bloomberg, raw stones are no longer being shipped from Russian mines to Surat, India, the diamond cutting and polishing capital of the world.

Traders and manufacturers are looking for workarounds, according to industry analysts, because Indian banks are hesitant or unable to handle payments with Alrosa due to OFAC restrictions.

Alrosa dispatched top executives to Surat earlier this week to discuss future sales with customers and trade associations.

To put things in perspective, Alrosa controls 33% of the world rough stone supply, roughly the same as De Beers. The impact of OFAC’s sanctions against Russia on the global diamond business has been seismic, as supply has tightened and prices have skyrocketed.

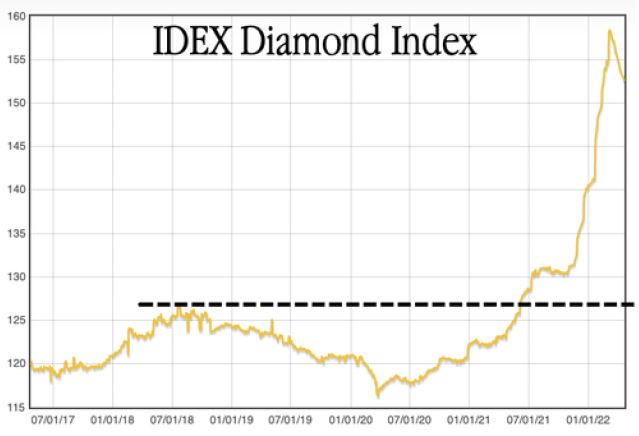

In the last two years, the Diamond Index on the International Diamond Exchange (IDEX) has increased by 36%.

According to these experts, Alrosa’s planned sale of rough stones was canceled because banks were unable to accept payments. Each year, the Russian miner holds only ten sales.

Meanwhile, resentment is developing among G-20 members, with some saying that they would continue to buy Russian stones. Despite OFAC’s sanctions, retailers in China, India, and the Middle East plan to continue buying.

Not all BRICs have surrendered to US pressure to cease buying Russian commodities, as we detailed earlier this week. It lends credence to the emergence of a multi-polar world.

According to industry experts, Alrosa’s meeting could result in a bilateral payment mechanism for the uncut stones (rupees for rubles). This could be another illustration of the Bretton Woods III system’s emergence, as Credit Suisse strategist Zoltan Pozsar recently publicized.

As supply tightens, the disturbances around Russian diamonds will continue, making the stone even more costly. Then there are lab-grown diamonds, which are an affordable choice to actual diamonds.

- Source : GreatGameIndia