Only 2 Million Bitcoins Are Left To Be Mined. Here’s Why

According to Bitbo statistics, the 19 millionth bitcoin was just mined, having left just under 2 million BTC for miners to distribute into circulation as the Bitcoin infrastructure ticks through a predetermined issuance schedule till it approaches the 21 million supply limit and stops creating new bitcoin.

The achievement reveals how Satoshi Nakamoto, Bitcoin’s inventor, was able to bring together decades of research in many areas of computer science to establish digital scarcity, a key component of Bitcoin’s value promise.

Prior to Bitcoin, virtual currency had a vulnerability known as dual spending. Until now, the sole method to guarantee that a party did not spend money twice was for a central body to keep track of coins transferred and received, updating users’ balances, just like the conventional banking system. However, Nakamoto’s creation facilitated computers that run a bit of software to rigidly enforce spending conditions that stopped a digital representation of value from being expended twice for the first time – or at least made it exorbitantly pricey to do so – by using the Proof-of-Work (PoW) framework in a distributed ledger.

While miners and nodes collaborate on bitcoin’s issuance and enforcement, investors who want to buy increasingly scarce BTC must compete for a piece of the asset’s finite supply. Miners used to sell their newly created bitcoin on the open market to cover operational costs in US dollars, but it is now typical for mining companies to add their produced coins to their balance sheet and offer bitcoin-backed loans as needed. As a result, Bitcoin has become even more scarce, as a larger portion of the overall quantity is locked up for the long term.

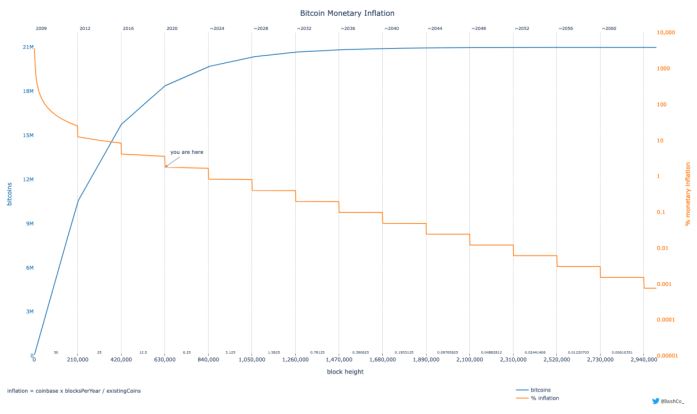

A miner presently receives 6.25 BTC each block mined. Since Nakamoto mined the very first block, which provided a 50 BTC reward, the block remuneration has been decreased in half per 210,000 blocks — nearly every four years. Each epoch, fewer new bitcoins are distributed, thereby raising the asset’s rarity. As a result, even though 19 million bitcoins have been mined in around a dozen years, the final 2 million will not be minted until 2140 if the system stays unchanged.

Surprisingly, the Bitcoin protocol’s supply limit of 21 million units is not stated in its white paper or code. Rather, the network enables the network to implicitly restrict the issue of bitcoin above the limit via the ever-decreasing amount of bitcoin awarded from each block in tandem with the decentralized network of computers upholding that payout.

In a blog post, cypherpunk and Casa co-founder and CTO Jameson Lopp noted, “Bitcoin implementations control new issuance by checking that each new block does not create more than the allowed block subsidy.”

The distributed system of Bitcoin nodes can implicitly impose the supply limitation by guaranteeing that bitcoin cannot be used repeatedly and that the block reward does not return more than it should at whatever particular time as the block reward approaches zero over the next century.

In addition to introducing scarcity to the digital domain, Bitcoin also provides a foreseeable monetary policy that can be planned ahead of schedule, which differs from the present financial system, which allows governments and policymakers to expand money supply as we have seen in recent years. As a result, monetary devaluation is impossible with Bitcoin, and the purchasing capacity of its users is guaranteed.

This image plots the trajectory of Bitcoin’s total supply (blue) against its rate of monetary inflation (yellow). Notably, Bitcoin’s inflation rate is known ahead of time through a software protocol enforced by thousands of computers scattered around the globe. As the block reward trends to zero until the next century, new bitcoins will not be issued and miners would reap only the fees of transactions on the Bitcoin blockchain. Image source: BashCo.

In addition to safeguarding people’s purchasing power, Bitcoin’s predictable policy allows users to prepare for the future, as they can rest assured that their money will not be debased. A strong dedication to long-term labour and investment, rather than short-term investments, may enable important societal advancements.

But, given BTC’s extreme scarcity, why has its value been stuck in a band of $30,000 to $60,000 for the past year?

The price of Bitcoin in US dollars might be viewed as a lagging reflection of humanity’s grasp of the technology and its creative value proposition. Only a tiny proportion of the world’s population understands the distinctive notions of algorithmically decentralized and rare money, so while the Bitcoin price may eventually trend to infinity, that will not happen until most of the world’s population – or most of the world’s capital – understands it. When they do, there may be a significant supply shock as a limitless amount of money floods into a finite number of bitcoin.

- Source : GreatGameIndia