Drugmakers Promise Investors They’ll Soon Hike Covid-19 Vaccine Prices

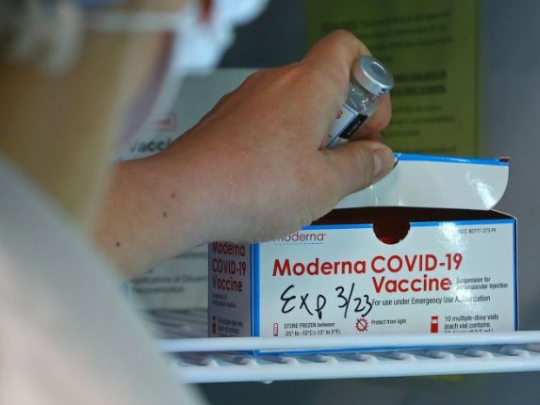

THE U.S. PHARMACEUTICAL FIRMS behind the approved coronavirus vaccines — Johnson & Johnson, Moderna, and Pfizer — have quietly touted plans to raise prices on coronavirus vaccines in the near future and to capitalize on the virus’s lasting presence.

While the companies have enjoyed a boost in goodwill from the rush to develop vaccines, drug industry executives have noted, the public is still sensitive to drug pricing and the reputational risk has, so far, curtailed their ability to reap large financial rewards.

But that environment, they hope, will change once the pandemic ends: a date that drugmakers themselves reserve the right to declare. Pharmaceutical officials, speaking at recent conferences and on calls with investors, say they expect the virus will linger, morphing from a pandemic into a perennial endemic. And as Covid-19 mutations continue to spread and booster shots may be required on a regular basis, leaders from the three companies are enthusiastic about cashing in.

“As this shifts from pandemic to endemic, we think there’s an opportunity here for us,” said Frank D’Amelio, the chief financial officer for Pfizer, at a conference. Additional factors, such as the need for booster shots, present “a significant opportunity for our vaccine from a demand perspective, from a pricing perspective, given the clinical profile of our vaccine.”

Moderna and Johnson & Johnson have also pledged affordability for their vaccines for the duration of the pandemic but have indicated to investors that they plan to return to more “commercial” pricing as early as later this year.

The vaccines are already poised to be some of the most lucrative drugs of all time. The companies are expecting to bring in billions in profit this year alone, and all the major drugmakers with approved coronavirus vaccines received investments and backorders from government agencies.

The U.S. government has fully financed the research and development of several coronavirus vaccines, including those produced by Moderna and Johnson & Johnson, to the tune of over $2 billion. The U.S. has also provided nearly $2 billion in payments to secure doses of Pfizer’s vaccine, which was developed in partnership with BioNTech, a company that received nearly $500 million in development assistance from the German government.

PFIZER, one of the early global leaders in the vaccine race, is very clear about the enormous moneymaking opportunity they see in the vaccines. D’Amelio, the company’s CFO, spoke on a Zoom call last Thursday at the Barclays Global Healthcare Conference, to discuss the issue.

Carter Lewis Gould, an analyst with Barclays Bank, noted that Pfizer faced the particular challenges with “optics” but asked when the company could “pursue higher pricing down the road.”

The current pricing, said D’Amelio, is “clearly not being driven by what I’ll call normal market conditions, normal market forces,” but rather the “pandemic state that we’ve been in and the needs of governments to really secure doses from the various vaccine suppliers.” Once the pandemic ends, he continued, there will be “significant opportunity” for Pfizer.

The comments build on a lengthy explanation of the financials of the vaccine laid out during Pfizer’s last quarterly earnings call. During the event, Pfizer executives announced that the company’s coronavirus vaccine was projected to bring in $15 billion this year alone from sales, of which $4 billion would be purely profit. The estimate would make the Pfizer coronavirus vaccine, according to observers, one of the highest-grossing pharmaceutical products of all time.

Those revenue projections are based on prices largely negotiated with governments under pandemic conditions, which could soon change. Pfizer, in its latest investor disclosures, revealed that it received advance payments for its vaccine totaling $957 million as of December 31. In the U.S., the company has agreed to a price of $19.50 per vaccine dose or $39 per patient based on a two-dose series. In the European Union, the company charges a higher rate, nearly $64 per dose. These figures, however, could increase. Pfizer’s pneumococcal vaccine, Prevnar 13, for instance, costs $200 per dose on the private market.

The company has faced calls for new price controls and to release the vaccine as a generic. Sen. Bernie Sanders, I-Vt., has demanded that Pfizer and other drugmakers share patents and intellectual property associated with the vaccine with the developing world in order to end the pandemic as fast as possible. The industry, through its vast network of lobbyists, has fiercely opposed the proposal, as well as similar calls for price regulations.

Pfizer Chief Executive Officer Albert Bourla, during the investor call, said the company had little to worry about in terms of political opposition.

“We believe the industry has generated a great deal of goodwill with Congress and public opinion through our Covid-19 treatment and vaccine efforts,” said Bourla. He added that he looked forward to working with the Biden administration and members of Congress from both sides of the aisle.

LAST YEAR, many pharmaceutical companies pledged to temporarily suspend many ordinary pricing strategies in order to help end the coronavirus crisis. Moderna made waves last October when the company announced that it would not enforce certain patent rights for its vaccine. AstraZeneca, whose vaccine has been approved abroad but not yet in the U.S., promised last year to only sell its vaccine on a nonprofit basis to the developing world “during the pandemic.”

But these promises have fallen short. Pfizer has reportedly pressed Latin American governments, including Argentina, to put up sovereign assets, such as embassy buildings and military bases, as collateral to cover the costs of lawsuits related to adverse effects of the vaccine.

AstraZeneca’s promises have been undercut by leaked agreements. In its deals with local manufacturers, AstraZeneca has stated that the company reserved the right to declare the end of the pandemic for pricing purposes. The Financial Times obtained a memorandum of understanding revealing that its promise not to profit from the vaccine during the pandemic would end as soon as July 1, 2021.

Moderna has not taken any steps to share vaccine intellectual property rights, manufacturing technology, or design and has declined to participate in the World Health Organization-backed fund to distribute low-priced vaccines to the developing world.

Moderna President Stephen Hoge, speaking at the Barclays Bank conference last week, similarly made clear that his company would remain sensitive to pricing concerns around affordability during the pandemic.

“Post-pandemic, as we get into those what I will call seasonal epidemics that you would expect to happen with a SARS-CoV-2 virus, we would expect more normal pricing based on value,” said Hoge.

Joseph Wolk, the executive vice president of Johnson & Johnson, speaking at the Raymond James Institutional Investors Conference this month, noted that investors could expect the company to reevaluate the vaccine for “pricing that’s much more in line with a commercial opportunity” when the pandemic is over.

Wolk noted that the end of the pandemic is a “fluid” question. The announcement, Wolk said, would come down to a percentage of people vaccinated, though he did not give any specific figures. The “pandemic period will be in place for the majority of this year, if not the entire piece of this year,” he continued, before making it clear that the declaration would be left to Johnson & Johnson.

“I think when we look at it, it’s not going to be something that’s dictated to us,” said Wolk.

The end of the pandemic may be declared by the World Health Organization or other international bodies. Drug firms, however, are not under a legal requirement to make prices based on the WHO’s determination.

Moderna and Johnson & Johnson did not respond to requests for comment regarding its pricing strategies and under what circumstances the firms would use to determine an end to the pandemic.

Asked for comment on when Pfizer would declare an end to the pandemic for pricing purposes, the firm instead released a statement from D’Amelio. “We are committed to the principle of equitable and affordable access for the Pfizer-BioNTech COVID-19 vaccine for people around the world,” said D’Amelio. “We have clearly stated in our public disclosures that we anticipate a pandemic phase that could last into 2022, where governments will be the primary purchasers of our vaccine.”

THE VACCINE MAKERS’ vague promises around affordability, while retaining a monopoly control of vaccine technology financed by public entities, have unsettled public health watchdogs.

Achal Prabhala — coordinator for the AccessIBSA project, which campaigns for access to medicines — notes that the U.S. government alone, through Operation Warp Speed, has pumped $18 billion into vaccine makers, in addition to advance payments for vaccines, ensuring that the pharmaceutical industry would face no financial risk.

“You know, Americans are amazed that they’re getting vaccines for free,” said Prabhala. “And of course they’re not because they’ve already paid for them once and now they’re amazed that they’re not paying for them twice.”

The pharmaceutical industry has faced declining public approval over the last decade. But the pandemic has presented a golden opportunity, noted Prabhala.

“Even though companies like Pfizer, which has not made the vaccine available to 85 percent of the world’s population, are enjoying immense popularity in the U.S. and Europe because of the fact that they got the vaccines done fast, and they seem to work well. That’s an unusually good position for pharma, they’re not used to being thought of as saviors,” he added.

But the companies have held out on drastic or even slight price increases on the vaccines, Prabhala continued, because they are managing the potential for reputational risk. “It’s pretty interesting that they are now waiting for the opportune time to raise prices once enough people have been vaccinated,” he added.

- Source : Lee Fang